Organizations planning to capitalize on their investments in the overseas market needs the advice of financial analysis regarding the reduction of risk limitations to gain profit and achieve desired growth in business. This is where the need for a Risk Analyst comes in. Risk Analyst professionals make use of their analytical skills and knowledge of the current business market to limit the losses that can occur in the future.

Risk Analyst- Definition

Risk Analysts work closely with the organizations to check the financial risks, i.e. from company costs to investments, and focus on reducing the unnecessary costs incurred. These professionals usually work for investment firms, banks, insurance companies, accounting firms, and more.

Risk Analysts consider the current market scenario and make necessary predictions regarding the company’s future considering the previous and current economic trends.

Some of the potential risks include the costs of location, chances of robberies, employee injuries, and more. The Risk Analysts assist the organizations to identify the risks involved and ways through which they could be prevented. Some of the preventive measures include identifying the ways through which the company can cut the costs involved without hampering the productivity of the organization.

Responsibilities of a Risk Analyst

The responsibilities under a Risk Analyst job role include the following:

- Analyze and determine the risks in order to assist the clients to make sound financial decisions

- Assist the clients to meet the financial goals of the organization

- Risk Analyst should be able to come up with the solution to reduce risks

- They must be able to thoroughly analyze financial statements like profit and loss, employee headcount reports, and company budget

- Thoroughly examine and interpret the statistical reports

- Predict the current trends in the business market and come up with suitable strategies

Essential Information:

Risk Analyst Qualification and Certifications

- Having a bachelor’s degree is the minimum requirement to apply for this position

- Having a bachelor’s degree in finance, statistics, economics, accounting, and mathematics is also suitable

- Risk Analysts should have been licensed by the Financial Industry Regulatory Authority (FIRA) prior to starting a job

- Another certification Chartered Financial Analyst (CFA) provided by the CFA institute is a quite popular certification. To obtain this certification, it’s mandatory for the candidate to have a bachelor’s degree, clear three various exams in the domain, and four years of professional experience

A postgraduate degree is not mandatory, but having one is truly beneficial considering your career prospects. Candidates who don’t possess a degree can still opt for a career as a Risk Analyst, but need to start at an administrative level.

Skills Required

- Risk Analyst should possess good knowledge of technical tools such as financial, analytical, accounting, and statistical tools

- Having knowledge of bank regulation and different categories of risk is essential

- Ability to make use of complex modeling techniques

- Ability to communicate your ideas through presentations and reports

- Ability to make intense decision-making skills to manage risk at the right time

- Ability to maintain good communication and negotiation skills to manage risk

- Ability to use financial models which in turn provides a clear picture of the decisions taken

- Create a risk level that the company is capable of handling

Areas of Focus

A few of the common areas of focus include operational/regulatory risk, market risk, and credit risk. Their overall job role includes protecting the organizational resources, reducing risks, and thoroughly going through the challenging business environment.

Market Risk Analysts

The concept of market risk analysis is all about considering how external factors like interest rates and the cost of commodities impact the financial performance of the company. These professionals work closely with financial firms to assess risks and returns. They make use of an analytical approach to analyze the market risks and guide the team to monitor and control the risks.

Regulatory Risk Analysts

The regulatory risk analysts take into account how laws impact the organization’s operations. A risk analyst needs to get prepared and respond on the company’s behalf in any debate.

Operational Risk Analyst

Operational Risk in an organization is mainly caused due to internal factors like staffing issues and weak controls. These professionals recognize the category of risks and report it to the seniors within the organization.

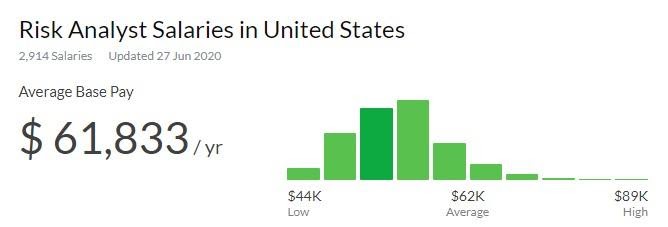

Salary Statistics

The average salary of a Risk Analyst is approximately around $61,833/year and can go up to $89,000 in the US depending upon their job role and experience.

Conclusion

There is a great demand for Risk Analysts globally. Make your resume stand out by showcasing varied experience, key skills, and relevant IT Governance Certification Courses and Project Management Certification Courses under your belt.

Some of the widely-recognized certification courses for risk management professionals are: