Do you ever feel overwhelmed by the number of potential projects competing for your attention? As a project manager, you’re constantly bombarded with ideas, requests, and proposals. However, selecting the right projects is key to moving your organization forward, especially when resources and time are limited, and there are many tasks to juggle. Making smart project choices can make all the difference in achieving success instead of just staying busy.

Here’s the good news: In 2024, with the business world changing faster than ever, you have a powerful toolkit to make informed decisions. This blog equips you, the project manager, to be the driver of your organization’s success.

We’ll explore the top project selection methods, from the tried-and-true financial analysis techniques to the cutting-edge risk assessment models. This is your roadmap to becoming a master project selector.

Get ready to take control, steer your organization toward success, and propel your career forward as a strategic decision-maker.

Table of Contents

- What is Project Selection?

- Understanding the Project Selection Process

- What are Project Selection Methods?

- Benefits of Project Selection

- Who Does the Project Selection Process?

- Project Manager Role in Project Selection

- Project Selection Criteria

- Steps Involved in the Project Selection Process

- Conclusion

What is Project Selection?

Project selection is the process of choosing which projects to pursue based on criteria such as organizational goals, available resources, budget, and expected outcomes. It involves evaluating different project proposals to prioritize projects that align with the organization’s objectives and offer the highest value or return on investment.

Effective project selection considers the impact of each project on the organization’s operations, stakeholders, and market position. It requires collaboration from various stakeholders to ensure a strategic and analytical approach to identifying opportunities that drive growth and achieve organizational success.

Understanding the Project Selection Process

The project selection process involves assessing the feasibility and potential benefits of various project ideas. This evaluation is typically conducted by individuals such as project portfolio managers, program managers, or the project management office (PMO).

Successful project selection leads to a higher return on investment (ROI), which is crucial for achieving financial success in any project endeavor.

A well-executed project selection process contributes to a project’s overall efficiency. By conducting thorough assessments in advance, many inefficiencies that could hamper project progress or risk its success during implementation can be mitigated or avoided altogether.

Moreover, aligning the selected projects with the organization’s strategic goals and objectives is a fundamental aspect of the project selection process. This alignment ensures that every project, whether individual or part of a portfolio, contributes meaningfully to the organization’s overarching mission and vision.

Such alignment enhances the organization’s ability to achieve its strategic objectives and maximize the value derived from its project investments.

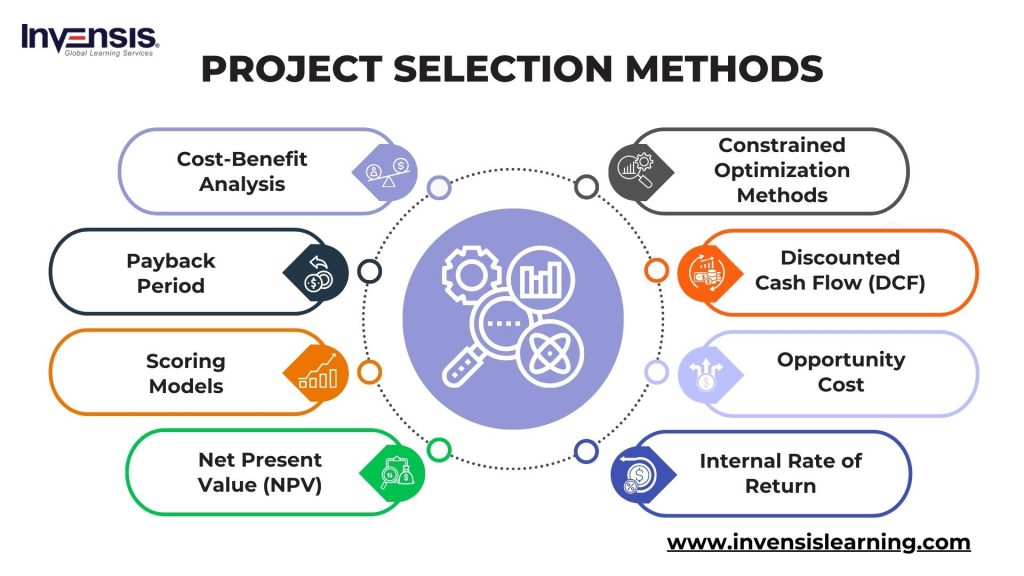

What are Project Selection Methods?

Project selection methods refer to the various techniques and approaches used to evaluate, compare, and prioritize different project proposals or ideas within an organization.

These methods offer a structured framework for decision-making, helping organizations identify and select projects that align with their strategic objectives, maximize value, and optimize the use of available resources.

Here are the top 8 common project selection methods include:

-

Cost-Benefit Analysis

Cost-benefit analysis is a project selection method that compares the expected costs of a project with its anticipated benefits to determine its financial viability and return on investment (ROI).

This method involves identifying and quantifying all relevant costs and benefits associated with the project, including initial investment, operational costs, and potential outcomes like revenue generation or cost savings.

By comparing these costs and benefits, decision-makers can assess whether the project offers a positive ROI and aligns with the organization’s strategic objectives. This helps them prioritize projects that deliver the greatest value and financial benefit.

-

Payback Period

The Payback Period calculates the time needed for a project to recover its initial investment through generated cash inflows or cost savings. It’s determined by dividing the total initial investment cost by the annual cash inflows or savings. The formula to calculate the payback period is as follows:

Payback Period = Cost of the Project/Average Annual Cash Inflows

A shorter Payback Period is generally preferred as it indicates faster recovery of the initial investment and lower financial risk.

Projects with a shorter payback period are often considered more attractive. They may be prioritized over projects with longer Payback Periods, especially when resources are limited or when quick returns on investment are desired.

-

Scoring Models

Scoring models serve as systematic tools project managers or selection committees utilize to assess and compare various project proposals. This method establishes a list of project criteria, which may include factors such as strategic alignment, potential ROI, feasibility, risk, and impact on organizational goals.

Each criterion is then assigned a score or rating to quantify its relevance, importance, and priority to the project.

By assigning scores to the predefined criteria, the scoring model offers a structured and objective framework for evaluating the merits of each project proposal. This helps eliminate subjective biases and gives decision-makers a clearer understanding of each project’s strengths and weaknesses.

-

Net Present Value (NPV)

NPV is a financial metric used in project selection and investment appraisal to assess the profitability of a project or investment over time. It defines the difference between the present value of cash inflows (such as revenue, cost savings, or other benefits) and the present value of cash outflows (such as initial investment costs and ongoing operational expenses) associated with a project or investment.

The concept behind NPV is based on the time value of money, which states that a specific amount today is worth more than the same amount in the future due to its potential earning ability.

By discounting future cash inflows and outflows back to their present values using a predetermined discount rate (often the organization’s cost of capital), NPV calculates the net value or profitability of the project.

-

Constrained Optimization Methods

Constrained optimization methods refer to mathematical techniques used to find the best solution to a problem subject to certain constraints or limitations. In project selection, these methods can be applied to identify the optimal combination of projects or investments that maximize a specific objective while adhering to various constraints, such as budgetary limits, resource availability, and organizational priorities.

The primary goal of constrained optimization methods is to find the most efficient and effective allocation of resources across multiple projects or investment opportunities to achieve the desired outcomes within the given constraints.

Various mathematical techniques, including linear programming (LP), integer programming (IP), and mixed-integer linear programming (MILP), can be utilized to solve constrained optimization problems.

These methods use algorithms and computational tools to systematically explore the feasible solution space, identify the optimal solution that maximizes the objective function, and satisfy all specified constraints.

-

Discounted Cash Flow (DCF)

DCF is a project selection method that takes a long-term view. It considers the time value of money, recognizing that a dollar today is worth more than a dollar tomorrow.

Here’s the core idea:

- Future cash flows from a project (e.g., profits) are less valuable than the cash received today

- DCF uses a discount rate to adjust these future cash flows to their present value, allowing you to compare projects with cash flows spread out over different time frames

Discounted cash flow is a valuable tool for project managers needing to assess the long-term financial viability of different options. It helps you make strategic decisions by considering the time value of money and ensuring your chosen projects deliver the most value to your organization over time.

-

Opportunity Cost

Opportunity cost helps decision-makers evaluate the benefits and drawbacks of choosing one project or investment opportunity over others.

When assessing project alternatives, Opportunity Cost considers the direct costs and advantages associated with each option and the potential returns or benefits that could have been obtained from the next best alternative.

This includes both financial and non-financial benefits, such as revenue generation, cost savings, strategic alignment, and resource utilization.

-

Internal Rate of Return

The Internal Rate of Return is the interest rate at which the Net Present Value (NPV) becomes zero, indicating that the present value of cash outflows matches the present value of cash inflows.

It is described as the “annualized effective compounded return rate” or the “discount rate that results in a net present value of all cash flows from an investment being zero.” When using IRR as a criterion for project selection, the project with the higher IRR is typically preferred due to its better profitability.

However, organizations should not depend only on IRR when evaluating a project’s worth. It’s also essential to consider other factors, such as the project’s NPV.

A project with a lower IRR may still have a higher NPV, and assuming there are no capital constraints, the project with the higher NPV should be prioritized as it maximizes shareholder profits.

Gain mastery in project selection methods by enrolling in Invensis Learning’s Project Management certification program now!

Benefits of Project Selection

Project selection plays a pivotal role in determining the success and effectiveness of an organization’s initiatives.

Some of the key benefits of effective project selection include:

- Increase Success Rates: Effective project selection significantly boosts the likelihood of project success by focusing on viable, well-aligned initiatives and minimizing the chances of failure due to poor planning, inadequate resources, or misalignment with organizational goals

- Optimize Resource Allocation: By prioritizing and selecting the right projects, organizations can allocate their resources—including financial, human, and material resources—more efficiently and effectively, maximizing the return on investment and minimizing waste

- Risk Management: Risk Management can help organizations to carefully do project selection to identify and evaluate potential risks connected with various projects, allowing them to make smart decisions and adopt risk mitigation techniques to reduce negative outcomes

- Enhance Financial Performance: Selecting projects based on their potential return on investment, net present value and other financial metrics can lead to improved financial performance, increased profitability, and enhanced shareholder value

- Improve Decision-making: Utilizing structured and data-driven project selection methods and criteria helps organizations make more informed, objective, and consistent decisions, reducing biases and subjectivity in the decision-making process

- Stakeholder Satisfaction: Selecting and prioritizing projects that align with stakeholders’ interests, expectations, and needs can increase stakeholder satisfaction, engagement, and support for organizational initiatives

Who Does the Project Selection Process?

The project selection process is typically orchestrated by a collaborative team comprising project managers, the Project Management Office (PMO), executive leadership, cross-functional departments, stakeholders, subject matter experts, and finance teams.

This diverse group collaborates to identify, evaluate, and prioritize potential projects based on alignment with organizational goals, strategic priorities, feasibility, financial viability, and resource availability, ensuring that selected projects offer maximum value, contribute to organizational success, and meet established criteria and objectives.

Project Manager Role in Project Selection

The project manager plays a pivotal role in project selection, acting as a strategic gatekeeper and champion.

Here’s how they contribute:

- Identifying Opportunities: Project managers actively seek and identify potential opportunities aligning with organizational goals and strategic objectives

- Feasibility Assessment: They conduct preliminary assessments to evaluate the feasibility of proposed projects, considering factors such as technical requirements, resource availability, and potential risks

- Project Proposal Development: Project managers assist in developing detailed project proposals, outlining objectives, scope, deliverables, timelines, and resource requirements

- Data Collection and Analysis: They gather and analyze relevant data, metrics, and information to assess the potential impact, benefits, and ROI of proposed projects

- Stakeholder Engagement: Project managers engage with stakeholders, subject matter experts, and cross-functional teams to gather insights, feedback, and perspectives during the project selection process

- Prioritization and Recommendation: Based on evaluations and analyses, project managers prioritize project proposals and make recommendations to senior management or decision-making committees for final approval

- Alignment with Organizational Strategy: They ensure that selected projects align with the organization’s strategic goals, priorities, and available resources

- Risk Assessment and Mitigation: Project managers identify potential risks and challenges associated with proposed projects and develop mitigation strategies to address them effectively

- Documentation and Reporting: They maintain documentation of the project selection process, decisions, and outcomes and provide regular updates and reports to stakeholders and management as required

Project Selection Criteria

Project selection criteria are a set of standards, requirements, or benchmarks used to evaluate and prioritize potential projects or investment opportunities within an organization. These criteria serve as a structured framework to ensure that projects align with organizational goals, strategic objectives, and resource capabilities.

Organizations can make informed, objective, and consistent decisions when evaluating project proposals by establishing clear and well-defined selection criteria.

Key components of project selection criteria often include:

- Strategic Alignment: The extent to which the project aligns with the organization’s mission, vision, and strategic goals

- Financial Viability: Consideration of the project’s estimated costs, the potential return on investment (ROI), net present value (NPV), and profitability

- Feasibility: Assessment of the project’s technical feasibility, including required resources, technology, and expertise, as well as market feasibility, considering demand, competition, and market potential

- Risk Profile: Evaluation of potential risks, challenges, and uncertainties associated with the project and the organization’s ability to manage and mitigate these risks effectively

- Resource Availability: Analysis of available resources, including financial, human, and material resources, and their adequacy to support the project

Steps Involved in the Project Selection Process

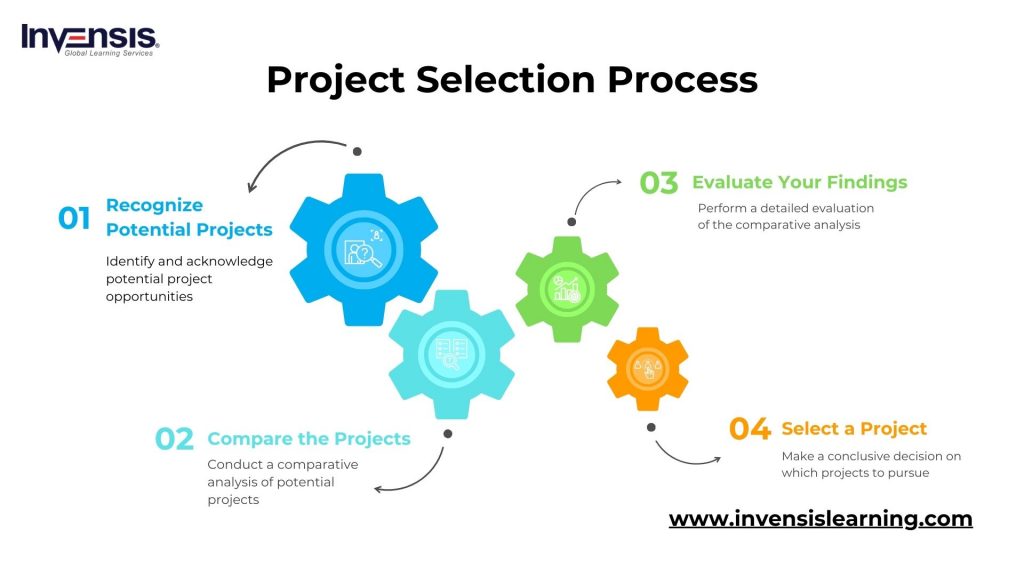

The project selection process involves several key steps to identify, evaluate, and prioritize potential projects or investment opportunities within an organization.

While the specific steps may vary depending on the organization’s size, industry, and objectives, the following are common steps typically involved in the project selection process:

-

Recognize Potential Projects

- Identify and acknowledge potential project opportunities aligned with organizational goals and priorities

- Actively seek and generate a list of viable projects based on market demands, customer feedback, and technological advancements

- Ensure awareness and consideration of all opportunities for growth, innovation, and improvement within the organization.

-

Compare the Projects

- Conduct a comparative analysis of projects using predefined selection criteria such as strategic alignment, financial viability, and feasibility

- Contrast each project’s strengths, weaknesses, opportunities, and threats to inform decision-making

- Prioritize and rank projects effectively to identify those offering the most value, benefits, and alignment with organizational goals

-

Evaluate Your Findings

- Perform a detailed evaluation of the comparative analysis to validate initial assessments and identify gaps or inconsistencies.

- Review and analyze collected data, information, and insights to refine understanding each project’s potential impact, benefits, and risks.

- Ensure an accurate understanding of the implications, requirements, and implications of selecting each project for informed decision-making

-

Select a Project

- Make a conclusive decision on which projects to pursue based on evaluating potential projects and their alignment with organizational objectives

- Prioritize and allocate resources to the selected projects for implementation, planning, and execution

- Set the stage for project initiation, monitoring, and management to ensure effective delivery and alignment with organizational goals and priorities

Conclusion

Project managers in 2024 have a diverse set of advanced project selection methods, ranging from quantitative financial metrics like NPV, IRR, and DCF to qualitative methods such as SWOT analysis and balanced scorecard.

These methods offer a structured and systematic approach to evaluate, prioritize, and select projects based on their alignment with organizational goals, financial feasibility, and potential impact.

By utilizing these top project selection methods effectively, project managers can make informed decisions, optimize resource allocation, mitigate risks, and drive successful project outcomes, ultimately contributing to organizational success.

Ready to Master Project Selection and Lead Winning Teams? Invensis Learning offers comprehensive Project Management Certification Courses designed to hone your skills and propel your career forward. Invest in your future—enroll now and become a project selection pro!